FOMC Minutes Reveal Divided Fed on Rate Hikes and Private Credit Risks

Minutes from the FOMC meeting confirm a divided Federal Reserve, with several members suggesting potential rate hikes and expressing concerns about vulnerabilities in private credit.

18 Feb, 13:44 — 18 Feb, 20:47

Perspective Analysis

Comparing sources…

Coverage Timeline

Canada Inflation Cools Slightly to 2.3% in January - The Wall Street Journal

FOMC Minutes Confirm Divided Fed: "Several" Suggest Rate-Hikes Possible, Fear Private Credit "Vulnerabilities"

‘Wouldn’t rule out’ inflation reigniting due to tariffs, labor costs – Charles Schwab’s Liz Ann Sonders

Fed’s January minutes indicate a return of rate rise discussions

Read at source (4 outlets)

Fed’s January minutes indicate a return of rate rise discussions

Several participants indicated they would have supported a ‘two-sided description’ for the rate outlook

Read full article →‘Wouldn’t rule out’ inflation reigniting due to tariffs, labor costs – Charles Schwab’s Liz Ann Sonders

Read full article →FOMC Minutes Confirm Divided Fed: "Several" Suggest Rate-Hikes Possible, Fear Private Credit "Vulnerabilities"

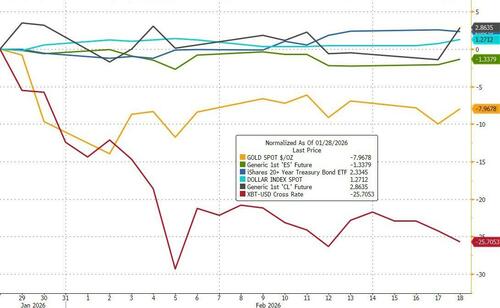

FOMC Minutes Confirm Divided Fed: "Several" Suggest Rate-Hikes Possible, Fear Private Credit "Vulnerabilities" Since the last FOMC meeting (where they held rates with two dovish dissents) on Jan 28th, Bitcoin has been the biggest underperformer (along with gold) while bonds and the dollar have rallied with stocks lagging... Source: Bloomberg March is 'off the table' for a rate-cut now (following last week's payrolls beat) but overall 2026 rate-cut expectations are dovishly higher since the last FOMC meeting... Source: Bloomberg With macro data confirming Powell's positive narrative (for now) Source: Bloomberg With Growth surprising to the upside and inflation drifting lower... Source: Bloomberg Today's Minutes could be more interesting than recent months since The Fed displayed a hawkish tone with Powell talking up a “clear improvement” in the US outlook during the press conference, and said the job market shows signs of steadying. So here's what The Fed wanted you to know about the last FOMC Meeting: A very divided Fed sees more rate-cuts (or hikes) possible and embraces lower inflation (and fears higher inflation)... Almost all supported maintaining 3.50-3.75%, while a couple preferred a 25bps cut, citing restrictive policy and labor market risks; "some" judged rates should be held steady for some time. (h/t Newsquawk) Policy outlook & rate guidance Almost all supported maintaining 3.50-3.75%, while a couple preferred a 25 basis point cut, citing restrictive policy and labor market risks. Several said further rate cuts would likely be appropriate if inflation declines as expected. Some judged rates should be held steady for some time pending clearer disinflation evidence. Some said it would likely be appropriate to hold the policy rate steady for some time while assessing incoming data. A number judged further easing may not be warranted until clear evidence shows disinflation is firmly back on track. Several favored two-sided guidance, noting upward adjustments could be appropriate if inflation remains above target. Vast majority saw downside employment risks as moderated, while inflation persistence risks remained; some judged risks more balanced. Several warned further easing amid elevated inflation could signal reduced commitment to 2% goal. A few cautioned overly restrictive policy could significantly weaken labor conditions. Neutral rate & financial conditions Those favoring no change said, after 75 basis points of cuts last year, policy was within estimates of neutral. Most expected growth support from favorable financial conditions, fiscal policy, or regulatory changes. Inflation views Inflation had eased markedly from 2022 highs but remained somewhat elevated relative to 2%. Elevated readings largely reflected core goods boosted by tariffs; some noted continued disinflation in core services, especially housing. Most cautioned progress toward 2% may be slower and uneven; risk of persistent above-target inflation seen as meaningful. Some cited business contacts planning price increases this year due to cost pressures, including tariffs. Several said sustained demand pressures could keep inflation elevated. Several expected ongoing housing services moderation to exert downward pressure on inflation. Several anticipated higher productivity growth would help restrain inflation. A few reported firms automating to offset costs, reducing need to raise prices or cut margins. Most longer-term inflation expectations remained consistent with 2%; several noted near-term expectations had declined from spring peaks. Labor market & growth Most said unemployment, layoffs and vacancies suggested stabilization after gradual cooling. Almost all observed layoffs remained low but hiring was also subdued. Several said contacts remained cautious on hiring amid outlook and AI uncertainty. Some cited lower net immigration as contributing to weak job gains. Vast majority judged stabilization signs and diminished downside labor risks. Most nonetheless said downside labor risks remained, including sharp unemployment increases in a low-hiring environment. Some pointed to soft survey measures and part-time for economic reasons as signs of lingering weakness. Activity seen expanding at solid pace; consumer spending resilient, supported by household wealth. Several cited disparity between strong higher-income and soft lower-income consumer spending. Several noted robust business investment, particularly in technology; several judged productivity gains would support growth. FOMC Minutes explicitly state high valuations, Mag 7 concentration, off-balance sheet funding, K-shaped economy and hedge funds piling into basis trades: In their discussion of financial stability, several participants commented on high asset valuations and historically low credit spreads. Some participants discussed potential vulnerabilities associated with recent developments in the AI sector, including elevated equity market valuations, high concentration of market values and activities in a small number of firms, and increased debt financing. A few participants commented that the financing of the AI-related infrastructure buildout in opaque private markets warranted monitoring. Several participants highlighted vulnerabilities associated with the private credit sector and its provision of credit to riskier borrowers, including risks related to interconnections with other types of nonbank financial institutions, such as insurance companies, and banks' exposure to this sector. Several participants commented on risks associated with hedge funds, including their growing footprint in Treasury and equity markets, rising leverage, and continued expansion of relative value trades that could make the Treasury market more vulnerable to shocks. A couple of participants commented that although consumer credit quality remained solid in the aggregate, there were signs of weakness in the financial positions of low- and medium-income households. A few participants noted the need to monitor potential spillovers from volatility in global bond markets and foreign exchange. Finally, The Fed commented on the yen "rate check" on behalf of the BOJ "In the days leading up to the meeting, the dollar had depreciated markedly after reports that the Desk had made requests for indicative quotes, known as "rate checks," on the dollar–yen exchange rate. The manager noted that the Desk had requested those quotes solely on behalf of the U.S. Treasury in the Federal Reserve Bank of New York's role as the fiscal agent for the U.S." Read the full FOMC Minutes below: Tyler Durden Wed, 02/18/2026 - 14:10

By Tyler Durden

Read full article →Canada Inflation Cools Slightly to 2.3% in January - The Wall Street Journal

Canada Inflation Cools Slightly to 2.3% in January The Wall Street Journal

Read full article →